Unlocking your take-home pay potential is crucial for financial stability and achieving your goals. One powerful tool to help you understand and optimize your earnings is the Virginia paycheck calculator. By utilizing this tool effectively, you can gain insights into your income, deductions, and ultimately maximize what you bring home each pay period.

In this guide, we’ll delve into how to use the paycheck calculator to its fullest potential, empowering you to make informed decisions about your finances.

Understanding Your Virginia Paycheck

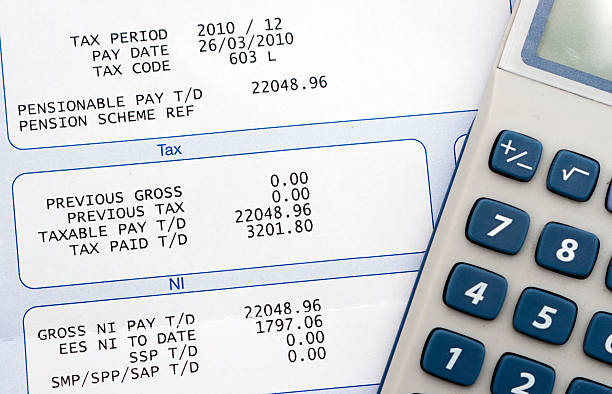

Before diving into the specifics of the paycheck calculator, it’s essential to grasp the components of your paycheck. Typically, your gross pay is the total amount you earn before any deductions or taxes are taken out. Deductions may include federal and state taxes, Social Security, Medicare, retirement contributions, health insurance premiums, and more. The amount you ultimately receive in your bank account is your net pay, also known as take-home pay.

How Does a Paycheck Calculator Work?

A paycheck calculator is an online tool designed to estimate your net pay based on various factors such as your gross income, deductions, tax withholdings, and other relevant information. These calculators are user-friendly and require inputting details such as your salary, pay frequency, filing status, allowances, and any additional deductions or contributions.

Key Benefits of Using a Paycheck Calculator:

- Accuracy: Paycheck calculators provide accurate estimates of your take-home pay, helping you plan your budget effectively.

- Transparency: By inputting different scenarios, such as changing your filing status or adjusting your retirement contributions, you can see how these changes impact your net pay.

- Financial Planning: Understanding your take-home pay allows you to make informed decisions about expenses, savings, and investments.

- Tax Planning: By adjusting your tax withholdings using the calculator, you can avoid overpaying or underpaying taxes throughout the year, potentially minimizing any tax liability or maximizing your tax refund.

- Salary Negotiation: When negotiating a salary or considering a job offer, a Virginia paycheck calculator can help you evaluate how different compensation packages affect your net income.

How to Use a Paycheck Calculator Effectivel?

- Gather Information: Collect details about your income, including your salary or hourly rate, pay frequency (e.g., weekly, bi-weekly, monthly), and any additional sources of income.

- Understand Deductions: Familiarize yourself with common deductions such as federal and state taxes, Social Security, Medicare, retirement contributions, health insurance premiums, and any other relevant deductions.

- Input Data: Enter accurate information into the Virginia paycheck calculator, ensuring you include all relevant details to obtain the most precise estimate.

- Adjust Variables: Experiment with different scenarios by adjusting variables such as filing status, allowances, retirement contributions, and other deductions to see how they impact your net pay.

- Review Results: Carefully review the calculated results to gain insights into your take-home pay and how various factors influence it.

- Take Action: Use the information provided by the Virginia paycheck calculator to make informed decisions about your finances, whether it involves budgeting, tax planning, or negotiating salary terms.

Common Mistakes to Avoid:

- Inaccurate Information: Providing incorrect data can lead to inaccurate calculations, so double-check all inputs for accuracy.

- Ignoring Deductions: Failing to account for all deductions can result in an inflated estimate of take-home pay, leading to unrealistic financial expectations.

- Forgetting Updates: Periodically revisit the paycheck calculator to reflect changes in your income, deductions, or tax laws to ensure continued accuracy.

- Not Seeking Guidance: If you’re unsure about certain deductions or tax implications, seek advice from financial advisors or tax professionals to maximize your understanding.

Conclusion

Unlocking your take-home pay potential is within reach with the help of a Virginia paycheck calculator. By leveraging this tool effectively, you can gain valuable insights into your income, deductions, and tax withholdings, empowering you to make informed decisions about your finances.

Whether you’re budgeting, planning for taxes, or negotiating salary terms, the paycheck calculator is a valuable resource for optimizing your financial well-being. Start maximizing your take-home pay today by utilizing this powerful tool.